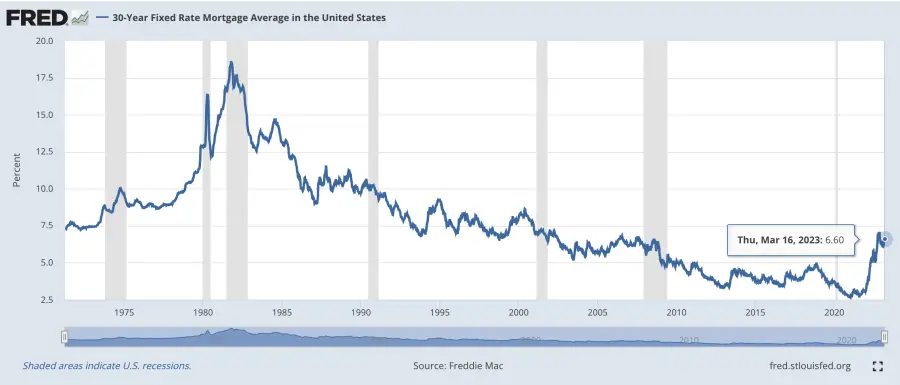

The U.S. mortgage rates climbed for five consecutive weeks and are now in the process of declining from 6.73% to 6.60% from a high of 7.08% in November 2022. As of today, the unemployment rate hovers at 3.6% and the producer price index (inflation) is at +4.6% since February 2022.

A year ago, your average 30-year fixed loan was 4.16%.

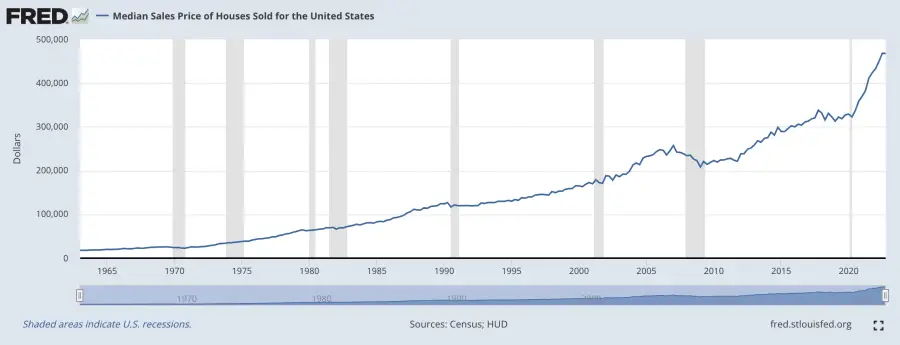

In the years during the pandemic, house prices first plummeted. Then, investors pounced on record-breaking prices on once very expensive properties. As demand surged, house prices skyrocketed once again, all with subsequent effects on the mortgage industry.

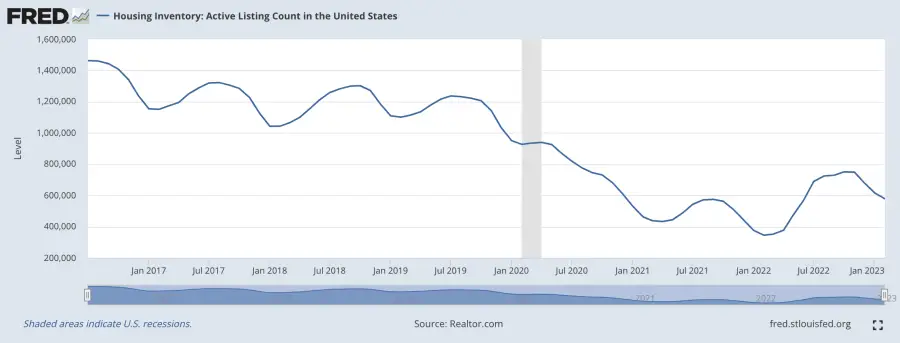

- The number of real estate listings went down, then up again. Buyers bought properties, house prices rose, and inventory fell.

- The median sales price of houses sold in the United States in Q4 of 2022 was $467,700.

- The median sales price of new houses sold in January of 2023 was $427,500.

- The average sales price in January of 2023 was $474,400.

- Below the January 2022 estimate of $831,000.

Whales Cause Waves.

In the 1980s, it was oil demand and supply. If one looks at all the recession data since the 1920s, the most notable spike presents a situation where investment opportunities generated demand.

The mortgage rates were highest in the 1980s due to a combination of factors, including high inflation, tight monetary policies, and global economic conditions.

Back in the 1970s, the Federal Reserve responded to inflation by increasing interest rates. This led to higher borrowing costs for banks, which, in turn, led to higher mortgage rates for consumers.

The U.S. Recession of the early 1980s represented a time of “stagflation”, where inflation and unemployment rates are both at their highest.

In 1981, the mortgage rate peaked at an average of 18.45%, which made it difficult for many people to afford homes or refinance their existing mortgages. It was only in the late 1980s that mortgage rates began to decrease due to lower inflation and economic growth.

Therefore, the commodity in demand, housing, or oil, represents a variable.

Today, it’s the mortgage and rental industry.

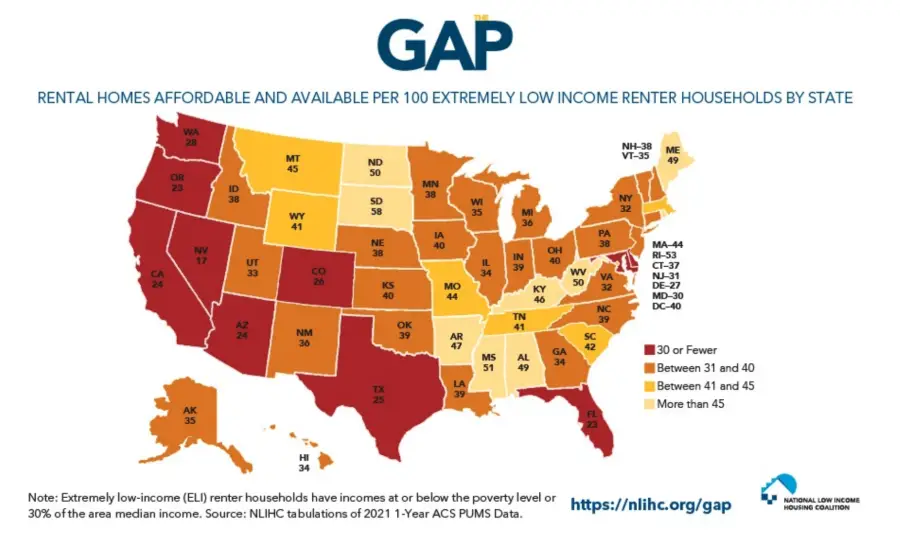

As of 2023, there are roughly 600,000 to one million homes for sale. Out of every 100 rental homes, 34 are affordable. In Illinois, there are 443,746 extremely low-income renter households, but only 150,392 affordable rental homes available to them, resulting in a shortage of 293,354 affordable and available rental homes.

Coincidentally, 34% of U.S. households are renters, however, in the top 25% net worth percentile, only 3.9% are renters. Your typical U.S. renter is a 39-year-old single male, university educated, and earns a median income of $42,500. The national median rent exceeded $2,000 in 2022.

That means that some of the 34% of American households are spending approximately $24,000 a year on rental expenses, a staggering 56% of their income.

The unemployment rate, seasonally adjusted between the years of 2021 and 2023, projects improvement on a downward trend according to the U.S. Bureau of Statistics.

The U.S. Inflation Rate is broken down into indexes used for measuring the various indicators and management systems for the overall economy. The most notable is the producer price index, much higher in the last 21 years at 4.6%.

The Breakdown of the Facts

In psychographic profiles throughout the world, there are at least two groups:

- Owners of property who are able to wisely generate rental income, after their own living (housing) costs have been zeroed or reduced and,

- Renters spending approximately 56% of their income on housing costs.

In New York, 3,551 properties test the market prices and volatility. Similarly in Las Vegas, 3,036 properties are up for sale in one of the most rapidly developed residential areas in the past 20 years. These two cities top the list of U.S. cities with the highest number of housing listings.

When your median price throughout the U.S. is approximately $470,000, one wonders, especially when the most affordable home is priced at $71,580 in Smith, Pennsylvania.

High mortgage rates will dissuade any first-time homeowner, regardless of the perks (known or not).

Freddie Mac gives us the news that the year started with rates on a 30-year fixed-rate mortgage going down with expectations of slower economic growth and inflation, as well as monetary policies loosening. However, because of sustained economic growth, along with high inflation rates, mortgage rates shot past the 7%-mark.

When a 5/1 ARM hovers at 5.81%, any person would reconsider if it costs more to rent or own. Nonetheless, the average homeowner consistently owns their property for about eight years, which directly contrasts with the simple concept of a 30-year fixed loan.

Essentially, an average homeowner pays for at many as 3.75 mortgage loans [or refinance fees] in a system designed for people intending to own their own home over the course of 30 years. Not only that, but homeowners are subject to fluctuations in home prices and rates beyond their control.

Such as an Iranian revolution limiting the world’s oil supply.

Or someone who’s able to buy 2,000 apartments at once is joined by their entire network.

The Solution & Conclusion

As a general rule of thumb, to get ahead, a person’s housing cost should remain less than 33%. Only then can an individual hope to save enough to create an emergency fund. Hopefully, that same individual goes on to earn more money and generate more savings.

Penultimately, that individual becomes a homeowner and continues to pay less than a third of their income for their home and shelter — the basis of operations for their family unit, genetically related or otherwise.

As housing prices drop, some homeowners may choose to rent out their properties rather than sell them. This can lead to an increase in rental supply, causing rental prices to decrease. However, if there is a high demand for rentals due to economic factors such as job growth or migration, then rental prices may remain high even in a crashing housing market.

The proposed roadmap for providing low-cost housing solutions in rural areas with high population density and consumption metrics is a promising strategy for addressing the pressing issues of high inflation, high unemployment, high housing prices, high mortgage rates, and wealth distribution.

A newer, better, modern residential area could be built with new materials and modern design enhancements. Residential homes could be built for a fraction of the cost of today’s single-family residences and financed at fixed rates, only to be refinanced if rates are indeed significantly lower.

Mutual funds could then be created by category and retail investors could contribute to key funds for materials, construction, and financing, based on a simple investment strategy:

- Find the highest savings interest available in the world at the most stable risk threshold.

- Account for variables such as inflation or dividend distribution on diminishing returns, but with the hope that continually, real estate increases in value as everything else becomes more expensive year by year.

This author sees a communal kitchen area modeled after Gordan Ramsay’s kitchen, garden, solar panels, and internet access in conjunction with a “familial homeostasis clause” — a clause that ensures the property would stay in the family as long as one family member chooses to be productive from it.

Perhaps scaled out on a statistical level, this would alleviate the current and projected global current housing crises in the next 20-40 years?