The wine market was a stagnant industry for decades, with various vineyards fighting over the same wine connoisseurs.

One company used an innovative marketing strategy to not only break into the market but become the most power global brand.

[yellow tail] wine stands as a testament to adapting to consumer research over sticking to traditional values and methods.

The Back Story

In 1981, Bill Deutsch formed what would become Deutsch Family Wine & Spirits (DFWS). DFWS first started with boutique wines from France, but later expanded into a model specializing in marketing and expanding wine sales for select vineyards and wine producers.

Throughout the 1980s to 1990s, Bill Deutsch and his son, Peter, rapidly secured marketing influence throughout New York and Boston, along with the rest of the eastern United States.

Leading up to 1998, Australian wine-maker John Casella was looking directly at U.S. expansion when Peter Deutsch of DFWS decided to import wine from Australia.

Almost by chance, both Casella Wines and DFWS happened to contact the Australian Trade Commission and the two groups were paired together.

“We determined wine at this price point from Australia just tasted better than from other regions; we decided we wanted to get involved in the Aussie business and deliver the best bottle of wine on the market for six bucks.”

Peter Deutsch, CEO of Deutsch Family Wine & Spirits, 2015.

Their First Joint Venture: Carramar Wines

Their first venture was Carramar Wines. Showcased in this 1998 merlot below, the label is black, noble, and even includes a family crest.

It completely flopped.

The Pre-2000 Wine Industry

Worldwide, approximately 1,000,000 million wine producers existed in 2000, with roughly 25% of them originating in France.

20% of all foreign wine purchased in the United States was fine French wine.

Wine experts and connoisseurs speaking on the industry had completely disregarded the potential of moving outside of its target customer group.

“So 35% of the population drinks alcoholic beverages but they don’t drink wine. They’ve tried it, they don’t like it. They’re beer or they’re spirits drinkers.

We don’t interview them much because they’ve said they don’t like wine so we’re not going to find out about wine.

Can those people be moved over?

Who knows.

But probably not.”

James T. Lapsley, Robert Mondavi & the Wine Industry, 2000

As a result, prior to 2001, there was 15-20% more wine available than people wanted to drink.

Only 10% of Americans drank wine regularly in 2001 and constituted almost 90% of all wine purchases.

Of the remaining 90% who were not regular wine consumers, roughly 44% did not drink and the remaining 46% preferred beer or spirits.

Crafting Winning Strategies in a Mature Market: The US Wine Industry in 2001

The Average American Wine Drinker in 2001:

- Aged 40-59 (51%)

- Lived in the suburbs or urban areas (80%)

- Caucasian/white (80%)

- Median household income of $78,100 (85%)

Overall, the global wine industry was worth roughly $130-$180 billion in 2001 with an average growth rate of 1-2% per year since 1994.

Yet it was also highly fragmented with no one company controlling more than 1% of global retail sales in the same year.

Crafting Winning Strategies in a Mature Market: The US Wine Industry in 2001

The U.S. market seemed stagnant in sales, yet the competition was still fierce. According to Blake Dvorak in his “Grape Expectations,” (American Enterprise, 2003), between the years 1975 and 2003, the number of US wineries, had increased from 600 to over 2,500 (400%).

With the oversupply of wines and little adherence to changing demand by seeking new wine drinkers, the low-end bulk market’s popular choices were best represented with:

By 2001, the global supply of wine began crowding stores and warehouses, pushing wine-makers from around the world to seek support from the Wine Market Council.

As a collective made up of vineyards, distributors, and major wine players, the Wine Market Council promptly synchronized a multi-million dollar ad campaign:

Wine. Since 6,000 B.C.

Targeting, Targeting, Targeting…And Pricing

With the average red wine costing approximately $15.66 dollars, [yellow tail] wine chose a very specific price point and audience…

..everyone who didn’t drink cheap or fancy wine.

With six generations of wine-makers in Yenda, Australia, the Casellas began the second round of their campaign with a key idea: everyone can enjoy wine.

Wine didn’t have to be bulk church wine or extremely expensive to be good.

Enter: The Best $6 Wine Money Can Buy

Launched in the U.S. in 2001, [yellow tail] wine became the fastest growing wine brand in America over the following decade, selling more than 1,000,000 cases in the first year.

In 2011, [yellow tail] wine topped the imported wine list in the United States of America.

The Casella Family of Casella Wines and Deutsche Family Wine and Spirits sold more wine to Americans than every French wine producer combined in less than ten years.

Targeting key audiences in 25 to 34-year-old females and males alike, their brand represented a simplified version of wine.

What’s with the [Brackets]?

As for the brackets used to depict the [yellow tail] brand name, the story is that the Casellas were looking up “kangaroo” in a textbook. John Casella then came across the definition of a wallaby.

Alongside the Latin form was the Australian version in brackets:

[yellow tail].

To set the wine apart, both the Deutsches and Casellas decided to keep the brackets and to use the lower case spelling.

“to underscore the wine’s lack of pretension,”

John Soutter, General Manager of Casella Wines.

From an Unknown Wine-Producer to Representing Australia to the World

Today, [yellow tail] wine continues to market to a diversified market audience.

Upon overview of @yellowtailusa on Instagram, the key strategy of being the best option in a middle market remains effective and charming.

The [yellow tail] wine Marketing Strategy

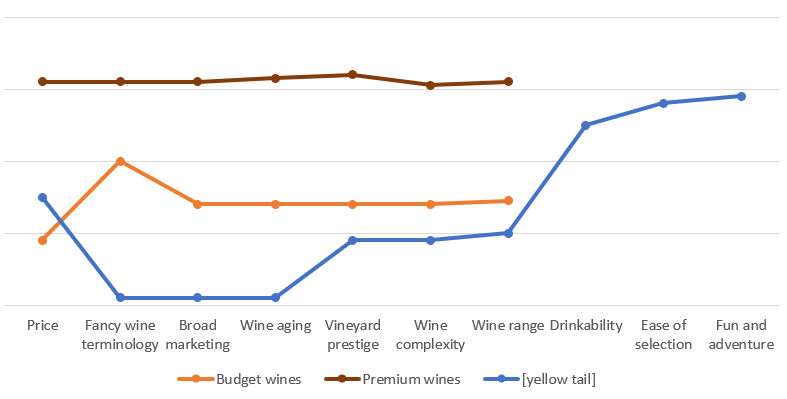

In the 1990s, wine in the United States was represented largely in two segments: high-value fancy wines vs mass-produced budget wines. In the 2000s, the wine industry was a very stagnant market with little to no growth.

The [yellow tail] wine strategy was simple:

1) The Logo was a Wallaby. Very different from your usual wine labels, the Casellas aimed to stand out.

2) Make an Excellent Wine that Tastes Good. People who were new to wine or mainly beer drinkers would like it. It’s tasty.

“it was delicious . . . an easygoing wine, uncomplicated and fun to drink.”

Peter Deutsche

3) No Fancy Labeling. Every single wine brand had the same fancy logo hailing origins from revered vineyards.

To remove all pretentiousness, [yellow tail] wine had fun, vibrant labels popping out on shelves. Like the logo, this helped catch the eye of shoppers walking down any grocery aisle.

The descriptions for [yellow tail] wine were simple and to the point; the wine bottle would say what the wine tastes like.

3) Clever Brand Positioning. Price points were placed above bulk wine and fine wine. A massive 85.6% of American people aged 18 and older reported that they drank alcohol in their lifetime, and 69.5 percent reported that they drank in the past. (niaaa.nih.gov, 2019).

4) Simplicity. Two wine types were launched in 2001: Chardonnay and Shiraz.

White and red.

Give The Consumer What The Consumer Wants

[yellow tail] wine executives undertook extensive research before launching their U.S. campaign. Seeking to enter the market from a different angle, the marketing team asked themselves key questions.

1) Reduce: Which factors should be reduced well below the industry’s standards?

Wine complexity

Wine range

Vineyard prestige

2) Create: Which factors should be created that the industry has never offered?Easy drinking

Ease of selection

Fun and adventure

3) Raise: Which factors should be raised well above the industry’s standards?Price versus budget wines

Retail store involvement

4) Eliminate: Which factors that the industry has long competed on should be eliminated?Enological terminology and distinctions [wine vocabulary]

Kim & Mauborgne, Blue Ocean Strategy

Aging qualities

Above-the-line marketing

With their answers, the [yellow tail] wines campaign had begun.

The Blue Ocean Strategy

In their academic paper, Kim & Mauborgne explained how [yellow tail] wine used a Blue Ocean Strategy.

“which consists of escaping the overcrowded market — a red ocean where all the sharks are attacking each other — and diving into a blue ocean where there is no competitor.”

Kim & Mauborgne, Blue Ocean Strategy

Demand is created rather than fought over.

Here were [yellow tail] wine’s strategy plots in 2001:

Strategically, while 1,000+ premium wineries tried to differentiate from each other, they were very similar in branding.

Being sweeter and softer than existing wines, [yellow tail] wine is easier to drink compared to more acidic and tannin-rich traditional wines. As a result, the decreased acidity reduced the heavy operational costs of wine-aging.

The Casellas pulled customers from all groups. Non-wine drinkers found the thought of drinking wine more approachable without needing to develop an acquired taste.

“The perfect wine for a public grown-up on soft drinks.”

Jon Fredrikson, Publisher on [yellow tail] wine

Throughout the campaigns, authentic bushman hats and jackets were handed out to wine store clerks.

Bush-hat-wearing retail wine sellers found themselves whole-heartedly recommending [yellow tail] wine to their customers.

“In the space of two years, [yellow tail] wine became the fastest growing wine brand in the US, and in 2003 it became the number one red wine in a 750ml bottle sold in the US.”

Kim and Maurborgne, Blue Ocean Strategy

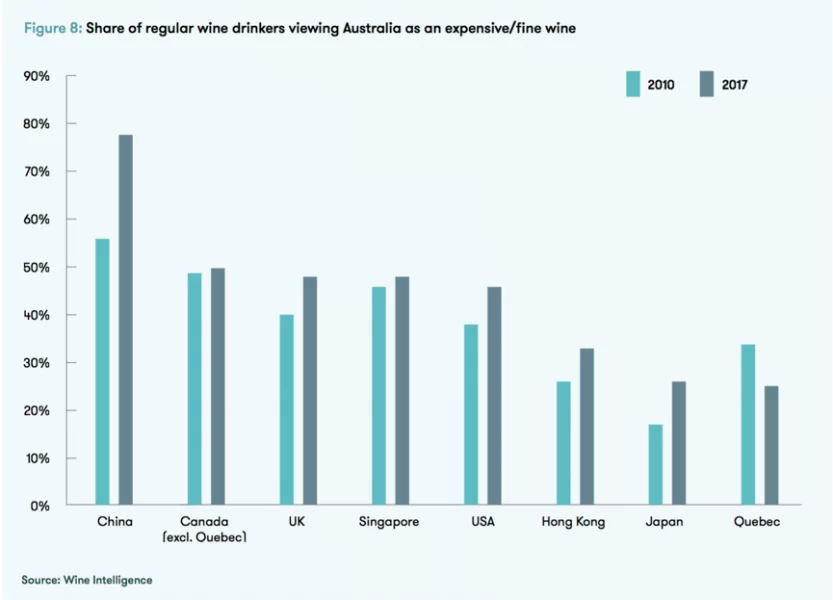

Over the course of seven years, [yellow tail] wine created a measurable change in the way Australian wines were perceived internationally. In China, Japan, and throughout North America, international wine-drinkers began to see Australian wine-makers as producers of fine wine.

Conclusion

The outside-the-box solution begins with a different perspective. Instead of producing what they thought would compete with the existing brands, the Casellas decided to go straight to what the consumer wanted:

A fun, decently priced bottle of wine that tastes just fine, does the trick and doesn’t break the bank.

And, the best in the under $10 category.