The Sequence of Events

- 98% of baby formula in the USA is produced locally, as opposed to China’s 60% in 2021.

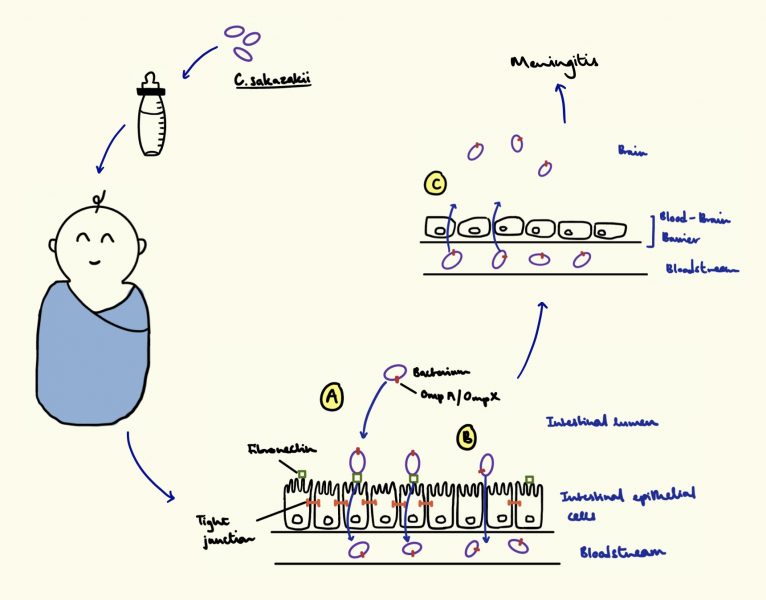

- At least four reports of Cronobacter sakazakii infections have been reported to FDA and the Centers for Disease Control and Prevention, and one Salmonella Newport infection has also been reported in connection with the outbreak. Consumers reported four infants who were sick, and who had been fed formula products made at the Sturgis plant.

- Federal officers began investigating bacterial contamination in formula and manufacturing plants.

- February 17th, 2022 – Abbott Nutrition, the largest infant formula manufacturer in the US, recalled three lots of powdered baby formula and halts production at an Abbott Laboratories manufacturing plant in Sturgis, Michigan.

- The US Food and Drug Administration conducted a six-week investigation in Sturgis, Michigan. This investigation should have been completed around the beginning of April 2022 and it’s still not certain the bacteria came from the plant; strains found at the plant didn’t match the two available samples from the babies.

- It’s May 19th, 2022 now, and over 50% of the baby formula in the United States has been purchased or stockpiled, generating fear and concern over both immediate needs, and monopolized systems.

Who is impacted?

Jill Branford and her 5-month old

Jill Bradford of New Kent has less than two days worth of the formula her baby needs. As a foster mom to a 5-month-old baby girl with medical needs, her baby requires an amino acid-based baby formula.

“We’ve called the WIC office,” said Bradford. “We’ve called Thrive, which is a supply company. We’ve called every hospital system in the state. I’ve contacted personally, every Kroger, Walgreens, Walmart, and CVS within the tri-cities area.”

Jill Bradford

The Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) provides federal grants to states for supplemental foods, health care referrals, and nutrition education for low-income pregnant, breastfeeding, and non-breastfeeding postpartum women, and to infants and children up to age 5 who are found to be at nutritional risk.

https://www.fns.usda.gov/wic

Bradford had found eight cans of the amino-acid-based formula on eBay, but for $800. Since these cans typically cost between $43 and $47, a shortage “tax”, is imposed by hoarders and those who have profited from people’s fears.

Steven and Zoie Hyde

Steven Hyde of San Diego faces a heart-wrenching challenge in finding formula for his fragile daughter, who was on an Abbott formula but has had to switch with the recall and subsequent shortages in other brands (switching brands and formula on our young is also hard on them). Zoie Hyde functions and lives without kidneys. At 19 months old, her rare condition requires that she undergoes dialysis and utilizes a feeding tube until she’s strong enough for a kidney transplant. Hyde said he used an organic brand from overseas until costs and customs hurdles made that too difficult. Friends and strangers from out of state have sent him other brands, but each time she switches requires more blood tests and monitoring.

Despite his challenges, Steven says proudly, “Zoie’s a shining light in my life.’’

Why is it so hard for Steven to consistently use organic brands from abroad?

In Germany, where production efficiency is at one of the best in the world, baby formula brands are regularly rejected or must be completely translated and repackaged to enter US markets, with a very small chance of winning WIC vendor contracts.

Each US state awards ONE contract to a baby food manufacturer to exclusively supply baby formula for the WIC program.

Once the manufacturer is part of the WIC program, they can take up more grocery store shelf space, and in general, sales go up after getting awarded a WIC contract.

For Canada, it’s a 17.5% import TAX on all baby formula products, with additional duties imposed based on the volume. And, this tax isn’t new; the measures have prevented Canadian manufacturers for decades.

What are the vendor regulations from WIC?

A vendor to the WIC is defined as a sole proprietorship, partnership, cooperative association, corporation, or other business entity operating one or more stores authorized by the State agency to provide authorized supplemental foods to participants under a retail food delivery system.

Most state WIC programs provide vouchers that families can use at authorized food stores. 46,000 merchants nationwide accept WIC vouchers, utilizing a procurement process under which FNS or the State agency chooses a single source (such as a single infant formula manufacturer offering the lowest price), as determined by the submission of sealed bids. Vendors that derive more than 50 percent of their annual food sales revenue from WIC food instruments are generally ineligible, which makes it considerably challenging for specialized baby formula companies to compete or even enter the WIC program.

Each store operated by a business entity constitutes a separate vendor and must be authorized separately from other stores operated by the business entity. Each store must have a single, fixed location, except when the authorization of mobile stores is necessary to meet the special needs. The selection of vendors remains under the administrative umbrella of the State.

Vendor overcharge means intentionally or unintentionally charging the State agency more for authorized supplemental foods than is permitted under the vendor agreement. It is not a vendor overcharge when a vendor submits a food instrument for redemption and the State agency makes a price adjustment to the food instrument.

https://www.fns.usda.gov/wic/wic-laws-and-regulations | § 246.12(g)(3) and (g)(4).

#hmmm…

This rule strengthens and simplifies current bidding requirements for using a single-supplier competitive system to provide a rebate for infant formulas. It also addresses new infant formula cost containment requirements which are needed due to recent changes in the infant formula industry. This rule also requires WIC state agencies to award infant formula rebate contracts based on the lowest net price, allowing the highest rebate as a basis of award only when the weighted average retail prices of the different brands of infant formula vary by 5 percent or less. A proposed rule was published July 16, 1998 and as a result of comments received we are publishing an interim rule.

https://www.fns.usda.gov/wic/wic-laws-and-regulations

Have they been updated since 1998?

No.

What is Joe Biden, the Whitehouse, and the FDA doing about the baby formula shortage?

- Cutting Red Tape to Get More Infant Formula to Store Shelves Quicker

- Calling on the FTC and State Attorneys General to Crack Down on Any Price Gouging or Unfair Market Practices Related to Sales of Infant Formula

- Increasing the Supply of Formula Through Increased Imports

More infant formula has been produced in the last four weeks than in the four weeks preceding the recall (Whitehouse, 2022) 一 regardless of the Sturgis manufacturing plant closure, and yet like toilet paper in 2020, baby formula continues to be short in supply while others hoard for their families or seek profits from fear.

US families still worry about the availability of infant formula, especially families that depend on specialty formulas such as the types manufactured at the Sturgis facility.

These 20 specialty formulas are used by about 5,000 infants as well as some older children and adults with rare metabolic diseases, and Abbott Nutrition is the only supplier for some of these formulas.

Whitehouse Press Release

What are they actually doing? @The White House’s Fact Sheet(s)

- Meeting regularly with major infant formula manufacturers to better understand their capacity to increase production of various types of infant formulas and medical foods. The infant formula industry is already working to maximize their production to meet new demands. Efforts already underway by several infant formula manufacturers include optimizing processes and production schedules to increase product output, as well as prioritizing product lines that are of greatest need, particularly the specialty formulas.

- Helping manufacturers bring safe product to the market by expediting review of notifications of manufacturing changes that will help increase supply, particularly in the case of the specialized formulas for medical needs.

- Monitoring the status of the infant formula supply by using the agency’s 21 Forward food supply chain continuity system, combined with external data. 21 Forward was developed during the pandemic to provide a comprehensive, data-backed understanding of how COVID-19 is currently impacting food supply chains.

- Compiling data on trends for in-stock rates at both national and regional levels to help understand whether the right amount of infant formula is available in the right locations, and if not, where it should go.

- Expediting the necessary certificates to allow for flexibility in the movement of already permitted products from abroad into the U.S

- Offering a streamlined import entry review process for certain products coming from foreign facilities with favorable inspection records.

- Exercising enforcement discretion on minor labeling issues for both domestic and imported products to help increase volume of product available as quickly as possible.

- Reaching out to retailer stakeholder groups to request that their members consider placing purchase limits on some products in order to protect infant formula inventories for all consumers.

- Not objecting to Abbott Nutrition releasing product to individuals needing urgent, life-sustaining supplies of certain specialty and metabolic formulas on a case-by-case basis that have been on hold at its Sturgis facility. In these circumstances, the benefit of allowing caregivers, in consultation with their healthcare providers, to access these products may outweigh the potential risk of bacterial infection. The FDA is working to ensure health care provider associations and stakeholders understand information about the risks and benefits of pursuing this product.

How many companies make baby formula? Is the US baby formula industry a tightly-knit monopoly?

Key Market Players

- ABBOTT LABORATORIES

- ARLA FOODS AMBA

- BOBBIE

- CAMPBELL SOUPS COMPANY

- DANA DAIRY GROUP LTD.

- DANONE SA

- D-SIGNSTORE

- ELSE NUTRITION HOLDINGS INC

- HIPP GMBH & CO. VERTRIEB KG

- HOLLE BABY FOOD AG

- KABRITA USA

- NATURE’S ONE, LLC

- NESTLE S.A.

- RECKITT BENCKISER GROUP PLC

- THE HAIN [bought] CELESTIAL GROUP, INC. [also manages Tilray]

Approximately 90% of the US infant formula market is controlled by four companies: Abbot, Mead Johnson Nutrition, Nestle USA, and Perrigo. 2% of US formula is imported from Mexico, Chile, Ireland, and the Netherlands. It’s a pretty short list, making it extremely difficult for new baby formula companies to enter the US market.

“The fact that there are so few companies means that when one factory is shut down, it creates a domino effect.”

Dr. Ann Kellams

“The [US] infant formula industry has reached an alarming level of corporate concentration.”

Secretary of Agriculture Tom Vilsack

What formula am I not supposed to use again?

The FDA is advising consumers not to use recalled Similac, Alimentum, or EleCare powdered infant formulas. Recalled products can be identified by the 7 to 9 digit code and expiration date on the bottom of the package (see image below). Products are included in the recall if they have all three items below:

the first two digits of the code are 22 through 37 and

the code on the container contains K8, SH, or Z2, and

the expiration date is 4-1-2022 (APR 2022) or later.

FDA

Biomilq anyone? Cell-Cultured Nutrition